On April 9, 2020, the Federal Reserve further clarified and updated the terms for the new 2020 Term Asset-Backed Securities Loan Facility (TALF 2020). The revised term sheet (found

here) has materially updated the following provisions: (i) the eligible borrower definition, (ii) the eligible collateral, (iii) pricing, (iv) collateral valuation, and (v) the conflict of interest provisions. Summaries of these changes are provided below:

(i) Eligible Borrowers:

The definition of “U.S. company” was amended and now includes companies created or organized in the United States, or under the laws of the United States, that have significant operations in and a majority of their employees based in the United States.

(ii) Eligible Collateral:

- Additional Asset Classes: The list of eligible collateral asset classes has expanded to include ABS with underlying credit exposure to leveraged loans, commercial mortgages and equipment leases.

- Removed Asset Class: The Federal Reserve has removed ABS backed by servicing advance receivables from the list of eligible assets.

- Ratings Requirements: The ratings requirement for eligible collateral has not changed, and still requires eligible ABS to receive the highest long-term or, in the case of non-mortgage backed ABS, the highest short-term investment grade rating from two nationally recognized statistical rating organizations (NRSRO), and must not have a credit rating below the highest investment-grade rating from an eligible NRSRO.

- New Issue Criteria: The eligibility criteria still require that, for all asset classes other than commercial mortgage-backed securities (CMBS), the ABS must have been issued on or after March 23, 2020. For a CMBS to be deemed eligible collateral, it must (i) have been issued prior to March 23, 2020, and (ii) have its underlying credit exposure to real property located in the United States or one of its territories.

- New Carveouts: The Federal Reserve has also specifically carved out CRE CLOs and single-asset, single borrower (SASB) CMBS from the newly included CMBS category, and will only allow static CLOs to be eligible collateral.

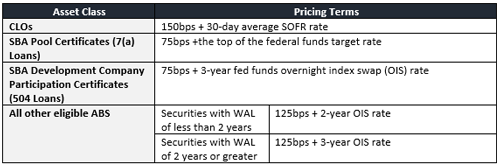

(iii) Pricing:

The Federal Reserve has updated its initial pricing terms, as set forth in the table below:

(iv) Collateral Valuation:

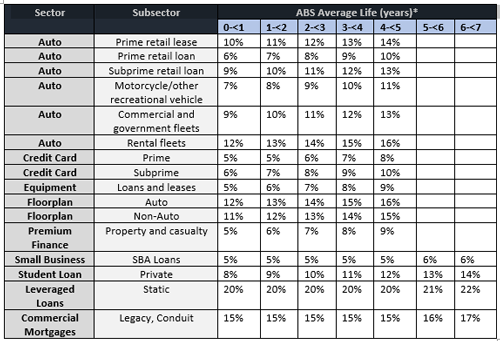

The haircut schedule, included directly below, has been added to the revised term sheet and is consistent with the haircut schedule used for the original TALF established in 2008 (TALF 2008).

*For auto, credit card, equipment, floorplan, and premium finance ABS, the weighted average life must be five years or less. For other new-issue eligible collateral, haircuts will increase by one percentage point for each additional year (or portion thereof) of average life beyond five years. For legacy CMBS with average lives beyond five years, base-dollar haircuts will increase by one percentage point of par for each additional year (or portion thereof) of average life beyond five years. No securitization may have an average life beyond ten years.

(v) Federal Government Official Conflict of Interest:

Pursuant to the new terms, eligible borrowers and issuers of eligible collateral will be subject to the conflicts of interest requirements found in section 4019 of the CARES Act. This provision generally prohibits any business that is directly or indirectly owned by the president, senior executive branch officials or legislative branch members (or their immediate families) from receiving any funds.

Aside from the revisions mentioned above, much of the initial March 23 term sheet remained unchanged, including (i) facility size, (ii) availability period, (iii) requirements for eligible borrowers, (iv) facility administrative fees, (v) maturity, (vi) recourse provisions, (vii) prepayment terms, and (viii) reservation of rights by the Federal Reserve to provide further terms and conditions and revise the current terms at a later date.

Potential 1940 Act Legal Considerations for TALF 2020

While specific details on TALF 2020 have yet to be released by the Federal Reserve, the Federal Reserve has indicated that TALF 2020 is expected to be substantially similar to TALF 2008.

Based on our experience with TALF 2008, it can be expected that registered investment companies wishing to participate in TALF 2020 should initially consider the following Investment Company Act of 1940, as amended (the 1940 Act) considerations. In connection with TALF 2008, some fund groups sought no action relief from the SEC in relation to Section 17 and Section 18 issues. Until further information is released on TALF 2020, it is unclear as to whether fund groups will be able to rely on those previous no action letter precedents (the NALs).1 It should be noted that without the specific details of TALF 2020, the below should not be considered an exhaustive list of 1940 Act issues for consideration:

(i) Section 17 of the 1940 Act:

It should be noted that a Rule 17f-1 issue regarding primary dealers arose in connection with TALF 2008. Specifically, TALF 2008 and the corresponding Master Loan and Servicing Agreement (the MLSA), which has not yet been released for 2020 TALF, depended upon primary dealers that had been selected by the Federal Reserve Bank of New York. The primary dealers were to be called upon to facilitate participation by registered funds and borrowers under TALF 2008. A primary dealer would have limited access to fund assets and would be selected by the participating fund based on an assessment of, among other things, the quality of its services and its creditworthiness.

If TALF 2020 follows an arrangement similar to TALF 2008, the primary dealer arrangement would not comply with Rule 17f-1 under the 1940 Act (which normally would govern the custody of fund assets by a primary dealer).

However, the NALs provided guidance on this issue. In the NALs, the SEC determined that this arrangement was permissible as it did not raise many of the safekeeping concerns underlying the rule or Section 17(f) generally.

Additional Section 17 legal considerations may be applicable to TALF 2020 once specific details have been released by the Federal Reserve.

(ii) Section 18 of the 1940 Act:

Section 18 of the 1940 Act restricts the ability of registered closed-end and open-end funds to issue or sell any class of "senior security." The potential issues that a fund or client may face if participating in TALF 2020 include:

- Section 18(a)(1) of the 1940 Act prohibits any registered closed-end fund from issuing any class of senior security or selling any senior security of which it is the issuer, that represents an indebtedness, unless (among other things) immediately after such issuance or sale the fund will have asset coverage of at least 300 percent;

- Section 18(c) of the 1940 Act, with certain exceptions, prohibits any registered closed-end fund from issuing any senior security representing indebtedness if immediately thereafter such fund would have outstanding more than one class of senior security representing indebtedness; and

- Section 18(f)(1) of the 1940 Act prohibits any registered open-end fund from issuing any class of senior security, or selling any class of senior security of which it is the issuer, except that the fund may borrow from any bank, provided that immediately after any such borrowing there is asset coverage of at least 300 percent for all of the borrowings of the fund.

In 2009, each of these concerns was resolved by the NALs which allowed funds to treat TALF loans in a similar manner to reverse repurchase agreements, as outlined by SEC Release 10666.2

(iii) Liquidity Risk Management and Rule 22e-4.

Rule 22e-4 (the Liquidity Rule) prohibits an open-end fund from acquiring any illiquid investment if, immediately after the acquisition, the fund would have invested more than 15% of its net assets in illiquid investments.

An illiquid asset is any asset that may not be sold or disposed of in the ordinary course of business within seven calendar days at approximately the value at which the fund carries the asset on its books. Although closed-end funds are not subject to this limitation, some closed-end funds have a non-fundamental investment policy to limit their investments in illiquid securities to 15% of their total assets.

Whether the above will be an issue for TALF 2020 remains to be seen as detailed information has not yet been made available. It should be noted, however, that back in 2009 the SEC stated that it was not in a position to provide no-action relief on any potential liquidity issues under the 1940 Act.

We will continue to monitor the guidance from the Federal Reserve and keep you posted as new information on TALF 2020 becomes available.

________________

1 See e.g., SEC No-Action Letter, Franklin Templeton Investments “Investment Company Act of 1940 – Sections 18(a)(1), 18(c) and 18(f)(1)” (June 19, 2009), available at: https://www.sec.gov/divisions/investment/noaction/2009/franklintempleton061909.htm.

2 SEC Release No. 10666, Apr. 18, 1979, available at https://www.sec.gov/divisions/investment/imseniorsecurities/ic-10666.pdf.

Information contained in this publication should not be construed as legal advice or opinion or as a substitute for the advice of counsel. The articles by these authors may have first appeared in other publications. The content provided is for educational and informational purposes for the use of clients and others who may be interested in the subject matter. We recommend that readers seek specific advice from counsel about particular matters of interest.

Copyright © 2020 Stradley Ronon Stevens & Young, LLP. All rights reserved.